Pay Off Your Debt for

Significantly Less than

You Owe

How It Works

You’re in control, our debt experts do the work.

Talk to us for a free consultation

Tell us your situation, then find out your debt relief options – no obligation.

We create an affordable plan

that works for you

Approve your plan, personalized from our suite of

products.

Get out of debt faster than you think

Take back your life in as little as 24-48 months.

Debt We Can Help With

We cover most unsecured debt and negotiate with major credit card issuers

and banks every day to reduce debts.

Credit Cards

Personal Loans

Lines of Credit

Medical Bills

Collections

Repossessions

Business Debts

Certain Student Debts

Take Back Your Life

David paid a fraction of what he owed in a shorter

amount of time

We cover most unsecured debt and negotiate with major credit card issuers

and banks every day to reduce debts.

David, Cat lover, tattoo aficionado

Starting Debt $36,883

Saved 38% with NDR

Debt Consolidation

Credit Counseling

Minimum Payments

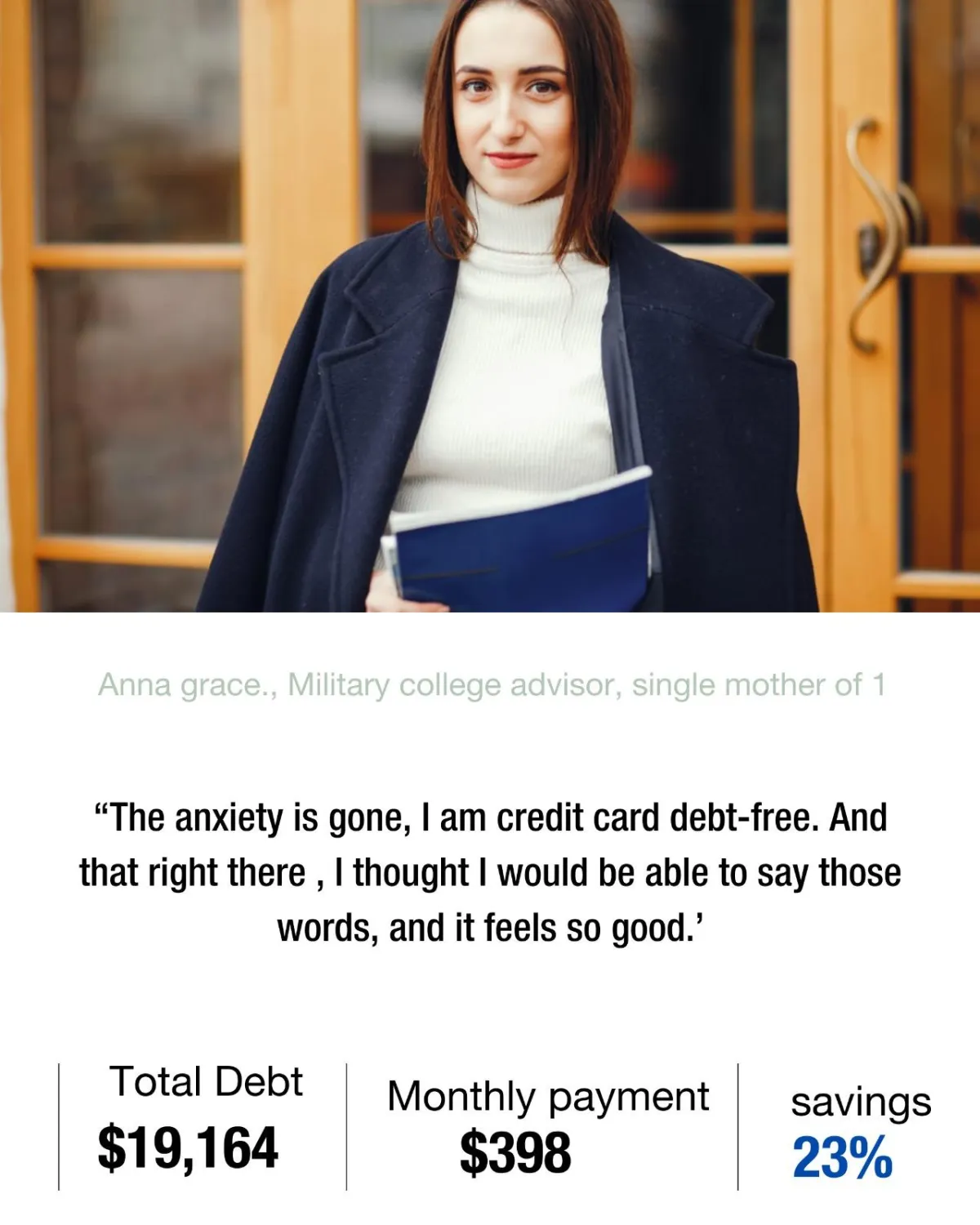

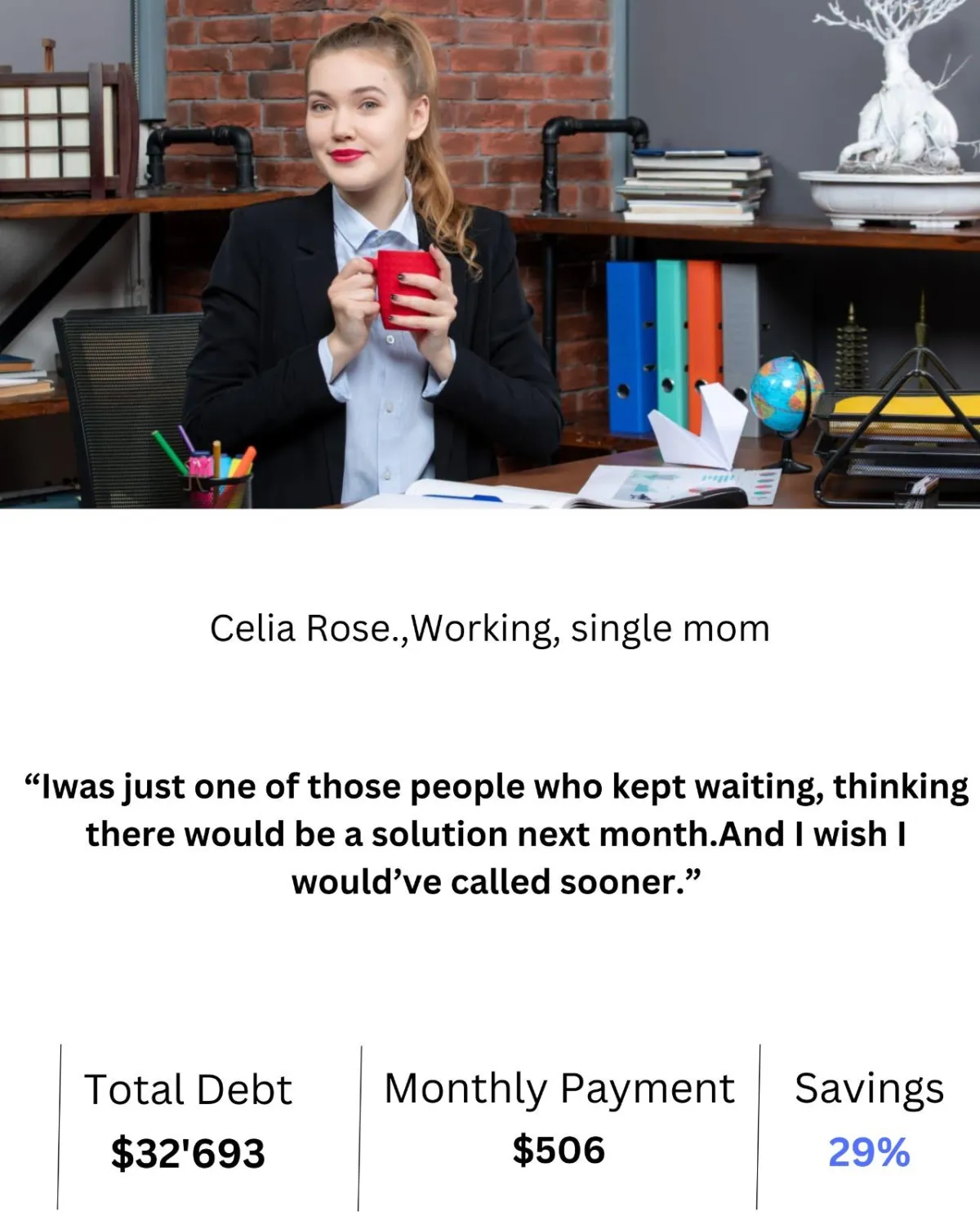

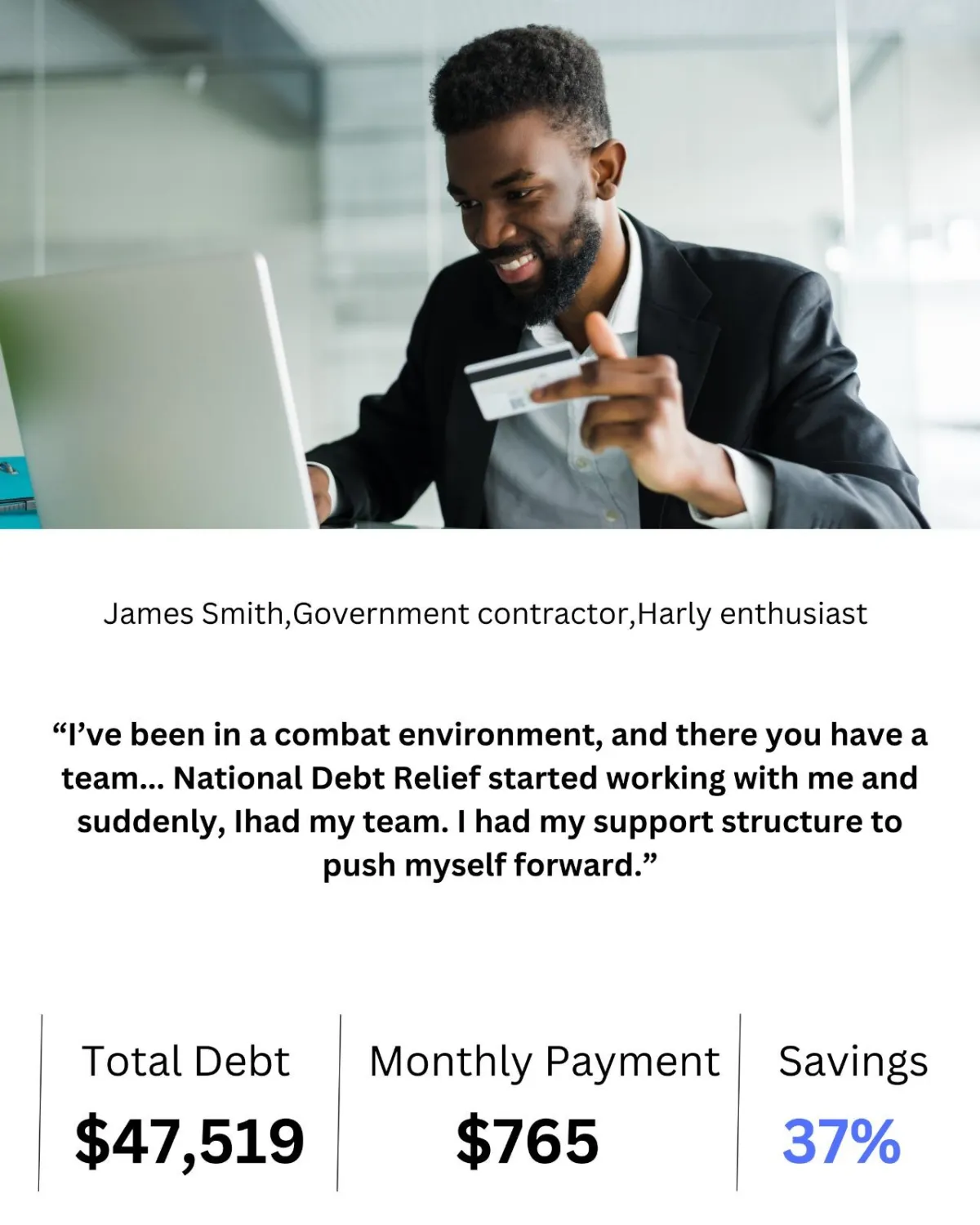

We’ve Transformed The Lives Of

Hundreds Of Thousands Of People

FAQs

Will your program impact my credit score?

Depending on your personal situation and whether you have already missed payments to your creditors, debt settlement programs may have a negative impact on your credit score. Due to it being a separately regulated service, we do not provide credit repair services or offer advice on ways to improve your credit.

What will your service cost me?

At Nationwide Debt Relief we do not earn anything unless we get you results. Specifically, 3 things must happen for a fee to be earned for the service. First, a settlement offer must be received from the creditor, we must receive your approval of the settlement, and finally at least 1 settlement payment to the creditor must be made. Only then would our fee be earned and charged to your Dedicated Account. Once debts are settled, the average client usually pays a free of up to 25% of the total debt enrolled But, until these 3 things occur, there is no fee for the service.

What’s the difference between Debt Settlement and Debt Consolidation?

Debt settlement reduces your balance. Your debt is negotiated down, and you pay less than you owe. The creditor forgives the remaining balance in a transaction called a settlement. Debt consolidation combines all of your debt into one loan with a single monthly payment, often at a reduced rate of interest. This typically requires a higher credit score for approval.

How will I know which is right for me?

A friendly, dedicated debt expert will let you know all your options and the advantages / disadvantages of each – which will help you decide what’s best for you.

What is your track record?

Since 2009, we’ve successfully helped hundreds of thousands of people get out of debt. We are one of the country’s largest debt relief companies and pride ourselves on our accreditations which include:–

A+ rating with the BBB– Over 21,000 five-star reviews of the Nationwide Debt Relief program– A team of debt arbitrators certified through the IAPDA (International Association of Professional Debt Arbitrators)

© 2024, Nationwide Debt Relief, All Rights Reserved.

All loans available through Nationwide Debt Relief LLC are made by lenders in their network and are subject to eligibility criteria and review of creditworthiness and history. All

loan and rate terms are subject to eligibility restrictions, application review, credit score, loan amount, loan term, lender approval, and credit usage and history. Eligibility for a

loan is not guaranteed. Loans are not available to residents of all states – please call a Nationwide Debt Relief representative for further details. Repayment periods range from 24

to 60 months. The range of APRs on loans is 6.25% to a maximum of 35.99%. APR. The APR calculation includes all applicable fees, including the loan origination fee. For

Example, a four year $18,000 loan with an interest rate of 18.134% and corresponding APR of 21.08% would have an estimated monthly payment of $528.79 and a total cost

payable of $8,281.48.

IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW ACCOUNT To help the government fight the funding of terrorism and money laundering activities,

Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you: When you

open an account, you will be asked for your name, address, date of birth, and other information that will allow the lender to identify you. You may also be asked to see your

driver's license or other identifying documents.

This website uses "cookies" to enhance your browsing experience and for marketing and tracking purposes. By continuing to browse our site you are consenting to their use.

For more information see our Terms and Privacy Policy